Global semiconductor material supply chain: opportunities and survival rules under the impact of tariffs

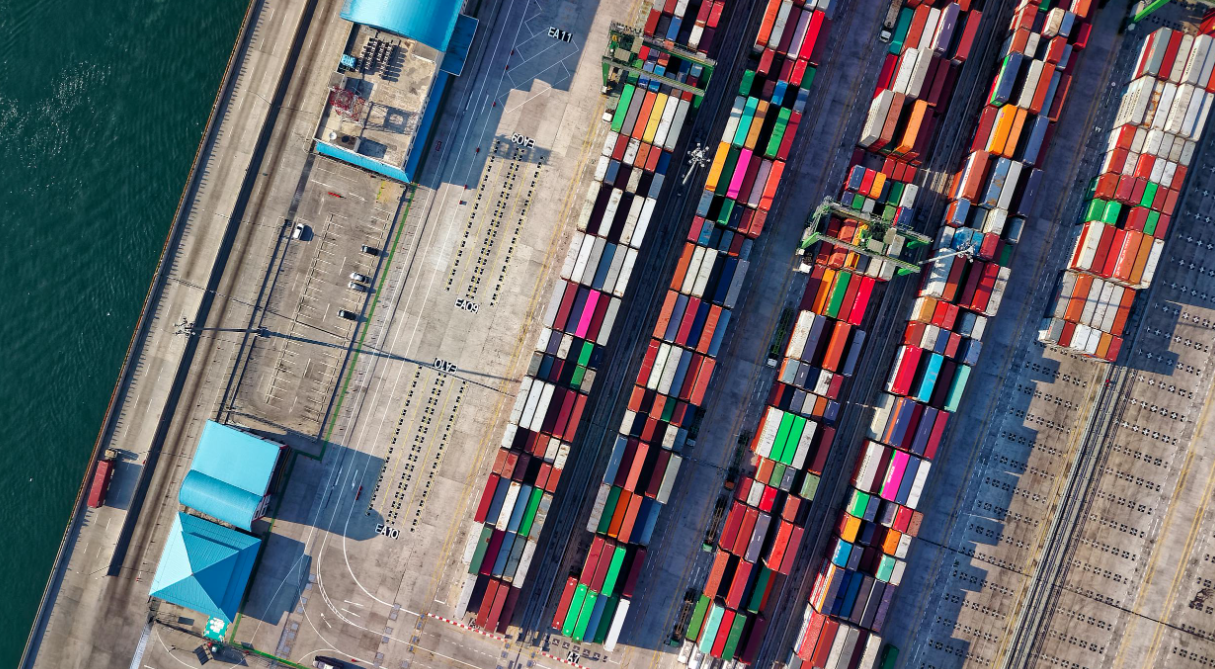

In 2025, the global semiconductor industry is experiencing a supply chain reconstruction caused by a tariff war. The high tariffs imposed by the United States and China on each other's semiconductor materials have not only pushed up production costs, but also exposed the fragility of the global semiconductor material supply chain. From photoresist to high-purity quartz, from electronic special gases to CMP polishing materials, these key materials supporting chip manufacturing are facing multiple tests of technical barriers, regional dependence and trade frictions. This article will analyze the challenges of the material supply chain from a global perspective and explore technological breakthroughs and diversification paths.

Critical materials under tariff impact: the "vulnerable link" of the global supply chain

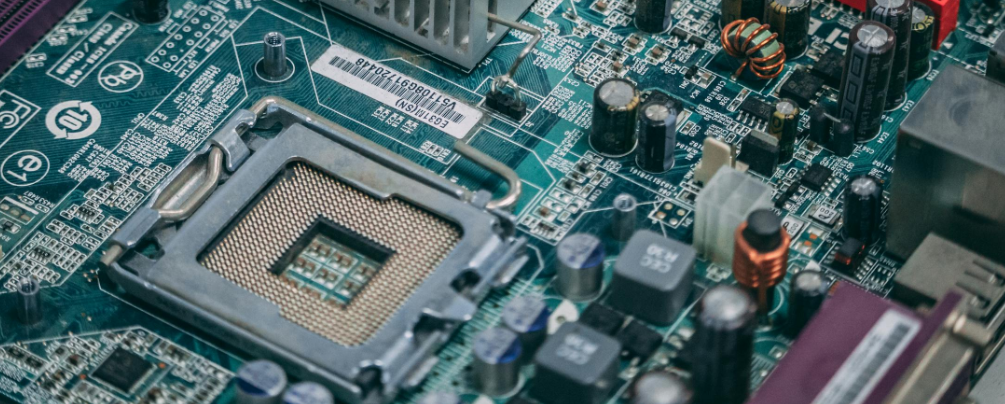

Semiconductor materials are the "invisible cornerstone" of chip manufacturing, running through the entire process of wafer manufacturing and packaging testing . Although terminal chip products have attracted much attention, the supply stability and technological advancement of upstream materials are the core factors that determine chip performance and yield. However, the global semiconductor materials market has long been monopolized by a few companies, with prominent problems of regional dependence and technical barriers.

1. Photoresist: the core bottleneck of advanced processes

Photoresist is a key material for chip graphics, and its technical threshold is concentrated in raw materials and formula research and development. The global market is dominated by Tokyo Ohka (JSR), Shin-Etsu Chemical and DuPont of the United States, and the supply of high-end ArF and EUV photoresists is highly concentrated. Taking EUV photoresist as an example, the mass production supply of its core resin materials still relies on Japanese companies, and the threshold for formula research and development and equipment investment is extremely high. Under the tariff war, the cost of imported photoresists has soared, forcing wafer fabs to turn to regional suppliers, but verification cycle and technology adaptability have become major obstacles.

2. CMP polishing materials: the game between monopoly and decentralization

Chemical mechanical polishing (CMP) materials are key consumables for chip flattening, and polishing pads and polishing liquids account for more than 80% of the material cost. Cabot Microelectronics and DuPont (Dow Chemical) in the United States have long dominated the polishing pad market, with a combined share of more than 70%; while the polishing liquid market is showing a decentralized trend, providing alternative space for regional companies. Although manufacturers in China, South Korea and other regions have achieved mass production of some polishing liquids, it will take time for high-end polishing pads to achieve technological breakthroughs. If tariffs push up import costs, it may accelerate the technical verification process of local companies.

3. Electronic specialty gases: global competition in purity and formulation

Special electronic gases (such as nitrogen trifluoride and tungsten hexafluoride) are the "invisible blood" in chip manufacturing, and the purity requirement is to reach more than 99.999%. The global market is monopolized by companies such as Air Products and Chemicals of the United States, Air Liquide of France, and Linde of Germany, which together account for more than 90% of the market share. Although companies such as China Walter Gas have achieved domestic substitution of some high-purity gases (such as 55 categories covering the 14nm process), the ultra-high purity gases required for the 5nm process still rely on imports. Under the tariff war, the stability of the gas supply chain has become an important consideration for wafer fabs .

4. High-purity quartz: global competition for strategic resources

High-purity quartz is an essential material for the manufacture of semiconductors and photovoltaic silicon wafers. Its scarcity and purification technology threshold are extremely high. The Spruce Pine mining area in North Carolina, USA, has long dominated the supply of high-end quartz, while most parts of the world still rely on imports. Although China, Russia and other countries have discovered new mineral sources and promoted purification technology in recent years, the scale of mass production and quality still need to be broken through. The tariff war may exacerbate the regional tension in quartz supply, but the research and development of alternative materials (such as new crucible materials) may become a long-term solution.

Technological breakthrough and supply chain diversification: coping strategies of global enterprises

Under the impact of tariffs, the resilience and technological autonomy of the semiconductor materials supply chain have become core issues for global companies.

Technological breakthrough: verification from laboratory to production line

Photoresist field: Japan's JSR and the United States' IBM are working together to develop a new generation of EUV photoresist, while South Korea's LG Chem has shortened the verification cycle by optimizing the resin formula.

Polishing materials: South Korea's Samsung and the United States' Applied Materials jointly developed a new polishing liquid to improve the planarization efficiency of the 3nm process ; China's Anjie Technology's polishing liquid has entered TSMC's supply chain.

Special electronic gases: Merck of Germany launched a new generation of CVD gases, and Walter Gas's lithography gas was certified by ASML, covering the 5nm process.

High-purity quartz: Swagelok of the United States has developed a new quartz purification process, and China has made phased progress in mineral source purification technology in Xinjiang, Henan and other places.

Supply chain diversification: regional layout and cooperation

wafer fab in Arizona has begun using products from domestic U.S. polishing material suppliers to reduce its dependence on the Asian supply chain.

Technology sharing: Japan's Shin-Etsu Chemical and the Netherlands' ASML are working together to develop a photoresist-lithography machine collaborative optimization solution to improve the stability of the EUV process.

Research and development of alternative materials: The Semiconductor Research Council (SRC) of the United States has funded a quartz alternative materials project to explore new crucible materials such as silicon carbide to reduce dependence on Spruce Pine quartz.

Conclusion: Supply chain resilience and technological collaboration are key

The tariff war exposes not only the supply chain problems of a single country, but also the structural contradictions of the global semiconductor materials industry. From photoresists to high-purity quartz, breakthroughs in material technology and diversified layout of supply chains require the coordinated efforts of enterprises, governments and academia. Although tariffs may increase costs and delay technological iterations in the short term, in the long run, they may accelerate the innovation and regional production of global semiconductor materials, and ultimately drive the industry towards a more robust and resilient direction.