Chip market under tariff storm: turbulence, substitution and localization breakthrough

The Sino-US tariff war will usher in a new round of escalation in 2025, with the tariff rate soaring from 34% to 125%, pushing the semiconductor industry to the forefront. This tariff game has not only reshaped the global chip supply chain, but also forced the Chinese semiconductor industry to accelerate its independence. In this storm, some people "hold on to goods and wait for price increases", some people cut off their arms to survive, and some people quietly rise.

1、Rules of origin rewrite the game: Who is “swimming naked”?

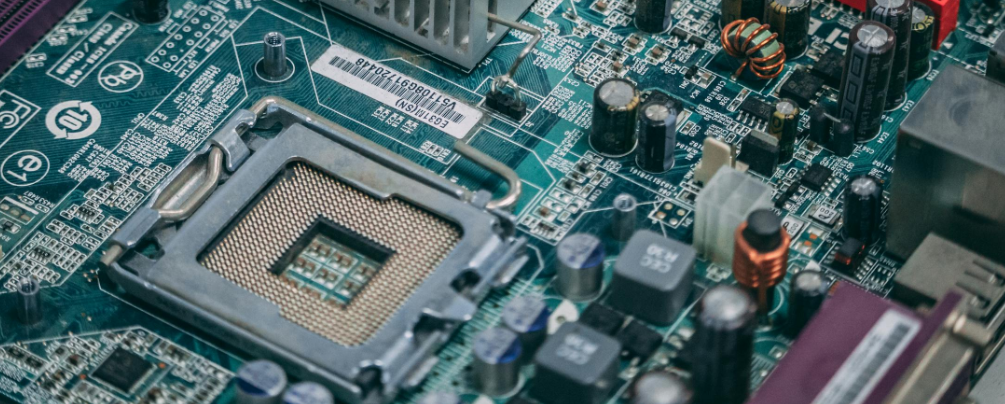

One of the focuses of the tariff war is the adjustment of the rules for determining the origin . According to an emergency notice from the China Semiconductor Industry Association, the origin of chips is based on the location of the "wafer fabrication plant" rather than the traditional packaging and testing location. This changedirectly determines whether the chips will face high tariffs:

Exemption list : Fabless companies such as Nvidia, AMD, and Qualcomm , whose chips are mostly produced in non-US factories such as TSMC and Samsung, and whose places of origin are Taiwan or South Korea, are therefore immune to tariffs.

Hardest hit areas : Intel, Texas Instruments (TI), Micron and other IDM (vertically integrated manufacturing) companies, due to the high proportion of domestic wafer fabs in the United States, their products will be subject to a 125% tariff, and their costs will increase sharply by 10%-20%.

This "taxation based on wafer production location" rule is essentially a precise countermeasure against the US semiconductor industry. As analysts point out, this move may force US companies to transfer production capacity to Southeast Asia or Europe, but the cost of migration is high and difficult to achieve in the short term .

2. The Ice and Fire of Huaqiangbei: Stockpiling, Suspension of Reporting, and Domestic Testing

Shenzhen Huaqiangbei, as the "barometer" of China's electronic components, was the first to feel the impact of tariffs. Many stalls suspended quotations for popular chips such as CPUs and GPUs, and some merchants even closed down and waited and watched .

Price chaos : A computer assembler revealed that the price of a computer with the same configuration soared from 5,000 yuan to 5,800 yuan within a week, forcing customers to postpone purchases.

Intensified differentiation : Memory chips have limited price fluctuations due to strong domestic substitution capabilities (such as Yangtze Memory Technologies); while analog chips such as TI and ADI may see a 30%-50% increase in channel prices due to their reliance on U.S. wafer production .

At the same time, domestic chip manufacturers have seen a turnaround. Many distributors have reported that downstream customers have begun to frequently inquire about domestic alternatives, and "shifting from passive acceptance to active embrace of the local supply chain" has become a consensus .

3. Domestic substitution: the battle from “usable” to “easy to use”

The tariff war exposed the shortcomings of the domestic chip industry, but also accelerated the process of localization:

Breakthroughs in mature processes : Scale substitution has been achieved in areas such as analog chips

(Shengbang Semiconductor, Nanochip ), MCU ( GigaDevice ), and storage (Changxin Memory ), and the revenue growth rate of some manufacturers exceeds 50%.

High-end chip breakthrough : Hygon and Kunpeng's CPUs based on x86/ARM architecture gradually penetrate the server market; Loongson has established a firm foothold in the party and government fields with its completely independent LoongArch instruction set.

Equipment and material breakthroughs : North Huachuang's etching machines and AMEC 's cleaning equipment have gradually entered the production lines of SMIC and other companies, and the self-sufficiency rate of materials such as photoresists and polishing pads has increased to double digits.

Despite this, high-end chips (such as AI computing chips ) still rely on imports, and the localization rate is less than 10%.

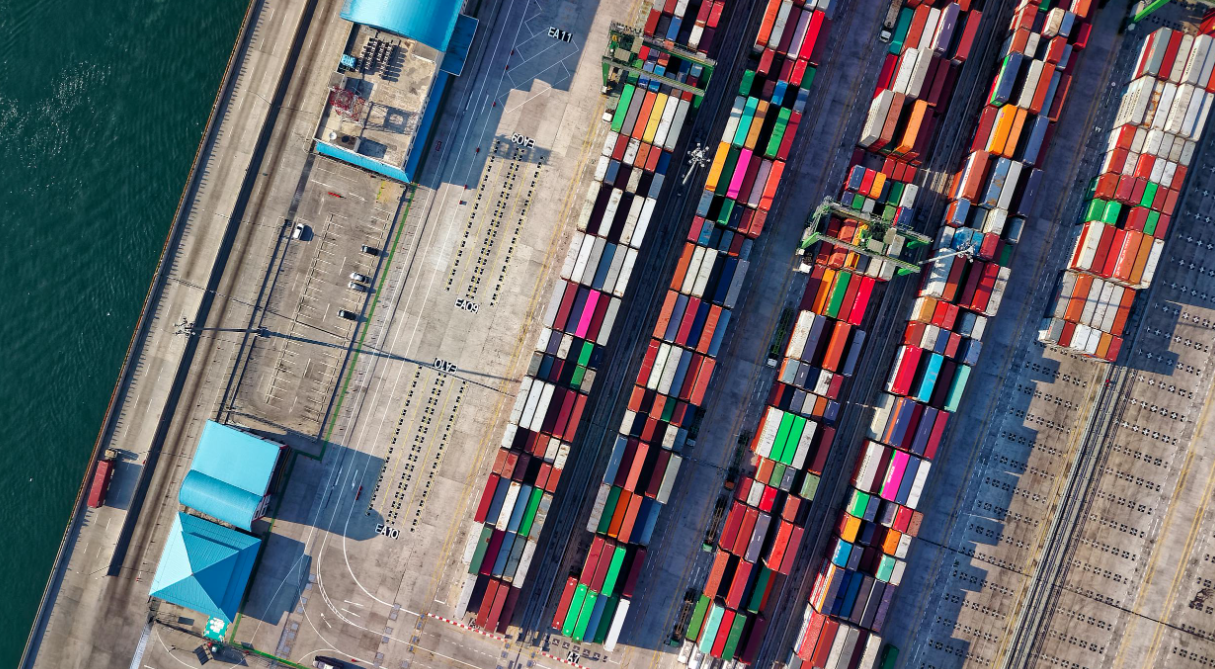

4. Industrial chain reconstruction: globalization or regionalization?

The tariff war is tearing apart the global semiconductor industry chain:

The dilemma of "manufacturing repatriation" in the United States : Intel tries to diversify risks through factories in Ireland and Israel, but high-end production capacity is still difficult to transfer.

China's "dual circulation" strategy : domestic manufacturers avoid risks through re-export trade in Southeast Asia, while leveraging domestic demand markets such as new energy vehicles and consumer electronics to drive the verification and expansion of domestic chips.

The rise of third-party forces : Europe, Japan and South Korea have become buffer zones in the game between China and the United States, and the "neutral" status of foundries such as TSMC and Samsung has become increasingly critical.

V. Future Outlook: Structural Upgrading under Pressure

In the short term, the tariff war has exacerbated market uncertainty, but it has also created a time window for

domestic chips. At the policy level, 1.3 trillion yuan of ultra- long-term government bonds focus on supporting semiconductor research; at the capital level, domestic equipment manufacturers have more verification opportunities; at the technical level, third-generation semiconductors (silicon carbide, gallium nitride) and quantum computing have become new tracks.

In this war without gunpowder, China's semiconductor industry is transforming from a "follower" to a "rule maker". As Huawei's rotating chairman Xu Zhijun said: "Tariff barriers may slow down the pace, but they cannot stop the torrent of technological innovation.

Conclusion

The tariff war is a mirror that reflects the shortcomings of China's chip industry and the determination to replace domestic products. From the stockpiling game in Huaqiangbei to the self- developed instruction set of Loongson , every grain of "sand" in this storm is laying the foundation for the future "Great Wall of Chips". In short, in this era full of variables, only companies that continue to innovate and actively adapt to changes can remain invincible in the fierce market competition. For the entire industry, all parties need to work together to build a more complete and efficient industrial chain to jointly meet future challenges and opportunities.